In the crypto and Web3 space, identifying “smart money” on-chain is a skill that requires patience and detailed analysis. Smart money typically refers to investors with foresight who can accurately predict market movements and take action before significant price changes. This article will share some personal experiences to help you efficiently identify and track these smart money investors.

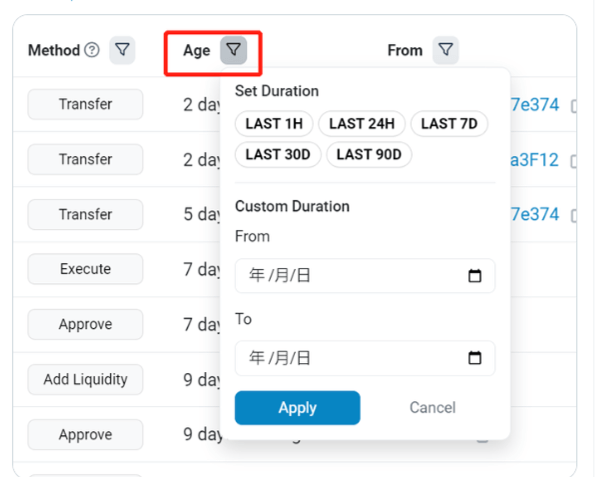

Using Etherscan’s Advanced Filtering Features

Etherscan is a blockchain explorer for Ethereum, offering powerful advanced filtering capabilities. You can use Etherscan to query addresses that bought a token in large amounts before its price surge and observe their selling behavior at peak prices. Here’s how to find smart money on-chain:

- Select a Time Range: Use Etherscan’s advanced filtering to select a large time range covering the period from when the token was cheap to when it surged. For example, you might choose the period from the token’s launch to its price peak.

- Analyze Large Transactions: Look for addresses that made significant purchases before the price explosion. These addresses often represent smart money. By filtering these transactions, you can identify investors with foresight.

- Observe Selling Behavior: Check if these addresses made large sales near the price peak. If they did, these addresses are likely smart money, profiting as the market reached its peak.

Case Study

Suppose you are monitoring a new DeFi project. You can use Etherscan to search for addresses that made significant purchases before the project’s token price skyrocketed and see if they sold during the peak. This method helps identify investors with market insight.

Distinguishing Between Active Purchases and Project Transfers

When analyzing transactions, especially those on decentralized exchanges (DEX) like Uniswap, it is crucial to differentiate between active token purchases and project transfers. Here are some methods to help you distinguish:

- Check Transaction History:

- Project Transfers: These usually involve one or more large transactions directly from project-controlled addresses to personal addresses. Such transactions do not pass through the Uniswap pool.

- Personal Purchases: Personal purchases involve the Uniswap pool. Check the transaction’s input and output addresses; if the Uniswap router address is involved, it’s likely a personal purchase.

- Analyze Transaction Path:

- Using Blockchain Explorers: Use Etherscan to view transaction details and focus on the transaction path. If the path shows a flow from a personal address through the Uniswap pool to the target token address, it’s likely a personal purchase.

- Direct Project Transfers: If the path goes directly from the project address to the personal address, it’s more likely a project transfer.

- Review Event Logs:

- Uniswap Transactions: Personal token purchases trigger Swap events. Use Etherscan or Web3 libraries (such as Web3.js or Ethers.js) to check the transaction’s event logs for Swap events.

- Project Transfers: Direct transfers do not trigger these Uniswap events.

Detailed Analysis

For example, if you notice an address receiving a large amount of tokens during a new project’s launch, check the transaction details. If the tokens come directly from a project address and not through Uniswap, it is likely a project reward or airdrop rather than a personal purchase.

Using On-Chain Data Analysis Tools

To conduct a deeper and more systematic analysis of on-chain data, you can use specialized tools like Nansen and Dune Analytics. These tools offer advanced data analysis and visualization capabilities, helping you accurately identify smart money’s transaction patterns.

- Nansen: Nansen is a powerful on-chain data analysis tool. It provides detailed address labels and behavioral analysis, helping you identify smart money addresses. With Nansen, you can track all transactions of specific addresses and gain deep insights into their investment behavior.

- Dune Analytics: Dune Analytics allows users to create custom queries and visualizations. You can use Dune to track transaction activities of specific tokens, analyze large transactions and wallet behaviors, and generate visual reports to better understand market trends.

Practical Application

With Nansen, you can set up alerts to notify you when specific smart money addresses make significant transactions. This way, you can stay updated on their actions and adjust your investment strategy accordingly. Similarly, with Dune Analytics, you can create a dashboard to analyze transactions of specific tokens and monitor market changes in real-time.

Personal Experience Sharing

Over the years of on-chain data analysis, I have summarized a few key points:

- Stay Data-Sensitive: Always monitor emerging projects and tokens in the market. Use data analysis tools and blockchain explorers to stay updated on large transactions.

- Build Analysis Models: Use Python or other programming languages to build your analysis models. Automate the processing of large transactions and behavior pattern recognition to improve efficiency. For example, you can write scripts to regularly fetch large transaction data from Etherscan and analyze transaction patterns.

- Community Involvement: Join crypto communities and follow key opinion leaders (KOLs) and experienced investors to get first-hand market information. Through community discussions, you can gain more market insights and understand which projects might become the next big thing.

By following these methods, you can more efficiently find smart money on-chain, giving you an edge in crypto and Web3 investments. I hope these experiences will be helpful to you. Let’s progress together in the world of blockchain.